來源:【多维新闻】2010-10-18

中共中央政治局常委、国家副主席习近平,在中共十七届五中全会上增补为中央军委副主席,为2012年在十八大上接替胡锦涛出任中共中央总书记迈出关键一步,显示出中共权力交接制度的稳定性和连续性。同时,作为接班人,习近平是否具有政治改革理念,备受各方瞩目。

中共十七届五中全会于10月15日至18日在北京举行。新华社18日授权发布的会议公报说,全会决定增补习近平为中央军事委员会副主席。军委掌控中国军队,胡锦涛也在担任国家主席前进入中央军委。

作为中共开国元老习仲勋之子,现年57岁的习近平是“太子党”领军人物,早年先后在福建、浙江、上海等地担任党委和政府要职。在2007年中共十七大上,任职中共上海市委书记仅7个月零4天的习近平连升三级,由一名普通中央委员,越过政治局跻身常委,并分管书记处,排名位居“团派”李克强之前,成为中共第五代接班人。

习近平这次出任中央军委副主席,可谓重返中央军委。1979年,习近平从清华大学毕业,分配到中央军委办公厅,担任习仲勋好友、中央军委秘书长耿飚的秘书,成为现役军人。现任政治局常委中,只有习近平有过从军经历,再加上习仲勋是陕甘边区革命根据地的主要创建者和领导者之一,这些因素让他在军界有相当大的优势。

出任军委副主席是接班人的必由之路。中共中央军委与国家中央军委虽然体系不同,却是“一套人马两块牌子”。主席由中共中央总书记、国家主席兼任,副主席通常有两至三人,除军方高级将领之外,其中一席由党内预定接班的文官兼任。赵紫阳与胡锦涛都曾任军委副主席,前者因六四事件下台,未能接班。江泽民直接接替邓小平任军委主席,则是六四特殊政治背景下的特殊安排。

去年十七届四中全会上,习近平未如预期般增补为中央军委副主席,出乎外界意料,后来传出是习近平主动致函中共中央,谦称自己到中央工作时间不长,尚不具备承担新工作的能力和条件。

外界对习近平的政治观点了解甚少。不过,习近平2009年在墨西哥会见华侨时痛批西方国家有人“吃饱了没事干”,对中国事务指手画脚,这番谈话引起舆论关注。另外,习近平最近在全国党史工作会议上提出坚决反对歪曲和丑化党史;在中央党校提出“权为民所赋,权为民所用”的权力观,为胡锦涛的“权为民所用”增加一个前提“权为民所赋”,也引人瞩目。

在十七届五中全会前,中国总理温家宝40多天内在国内外8次提到政治体制改革,并以“人民的希望和意愿不会止息,顺之者昌,逆之者亡”期许新一代领导人继续推动政治体制改革。中共是否以及如何推动政治体制改革,已经成为媒体关注焦点。作为接班人,习近平是否具有政治体制改革理念,备受各方瞩目。

有分析认为,习近平的父亲习仲勋因受小说《刘志丹》案牵连,于1962年被撤销国务院副总理兼秘书长职务,在“文化大革命”中又受到残酷迫害,被审查、关押、监护长达16年。1978年复出后在广东推行改革开放,“杀出一条血路”,回到中央任职后又全力支持胡耀邦、赵紫阳改革,与保守势力周旋。如果习近平能够体察其父所遭受苦难的根源,继承其父政治风骨与改革精神,应该支持甚至推动政治体制改革。

习近平在公众场合不苟言笑,“为人处事沉稳,从不感情用事”。其夫人彭丽媛是女高音歌唱家,中国第一位民族声乐硕士,中国人民解放军最年轻的文职将军,现任全国政协委员、解放军总政治部歌舞团团长、中国音乐家协会副主席。互联网近日盛传,习近平独生女习明泽已成为美国哈佛大学新生,但哈佛大学基于保护个人隐私拒绝证实。

在此次官方授权新华社发布的习近平简历中,对其部队任职经历进行了详细说明。

附:中共中央军事委员会副主席习近平简历

习近平,男,汉族,1953年6月生,陕西富平人,1969年1月参加工作,1974年1月加入中国共产党,清华大学人文社会学院马克思主义理论与思想政治教育专业毕业,在职研究生学历,法学博士学位。

现任中共中央政治局常委、中央书记处书记,中华人民共和国副主席,中共中央军事委员会副主席,中央党校校长。

- 1969-1975年 陕西省延川县文安驿公社梁家河大队知青、党支部书记

- 1975-1979年 清华大学化工系基本有机合成专业学习

- 1979-1982年 国务院办公厅、中央军委办公厅秘书(现役)

- 1982-1983年 河北省正定县委副书记

- 1983-1985年 河北省正定县委书记,兼任县武装部第一政委、党委第一书记

- 1985-1988年 福建省厦门市委常委、副市长

- 1988-1990年 福建省宁德地委书记,兼任宁德军分区党委第一书记

- 1990-1993年 福建省福州市委书记、市人大常委会主任,兼任福州军分区党委第一书记

- 1993-1995年 福建省委常委,福州市委书记、市人大常委会主任,兼任福州军分区党委第一书记

- 1995-1996年 福建省委副书记,福州市委书记、市人大常委会主任,兼任福州军分区党委第一书记

- 1996-1999年 福建省委副书记,兼任省高炮预备役师第一政委

- 1999-2000年 福建省委副书记、代省长,兼任南京军区国防动员委员会副主任、福建省国防动员委员会主任,省高炮预备役师第一政委

- 2000-2002年 福建省委副书记、省长,兼任南京军区国防动员委员会副主任、福建省国防动员委员会主任,省高炮预备役师第一政委(1998-2002年清华大学人文社会学院马克思主义理论与思想政治教育专业在职研究生班学习,获法学博士学位)

- 2002-2002年 浙江省委副书记、代省长,兼任南京军区国防动员委员会副主任、浙江省国防动员委员会主任

- 2002-2003年 浙江省委书记、代省长,兼任省军区党委第一书记,南京军区国防动员委员会副主任、浙江省国防动员委员会主任

- 2003-2007年 浙江省委书记、省人大常委会主任,兼任省军区党委第一书记

- 2007-2007年 上海市委书记,兼任上海警备区党委第一书记

- 2008-2008年 中央政治局常委、中央书记处书记,中央党校校长

- 2008- 中央政治局常委、中央书记处书记,中华人民共和国副主席,中央党校校长

中共第十五届中央候补委员,十六届、十七届中央委员,十七届中央政治局委员、常委、中央书记处书记。第十一届全国人大第一次会议当选为中华人民共和国副主席。

作者:英国《金融时报》首席经济评论员 马丁•沃尔夫 2010年09月30日

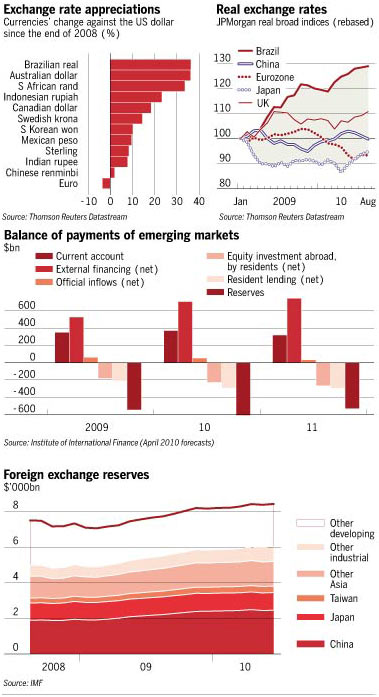

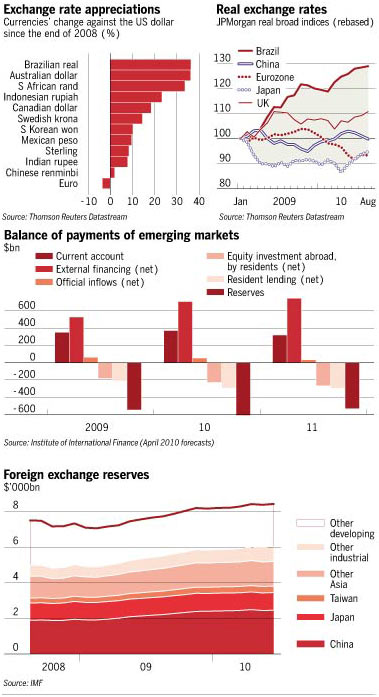

“我们正处在一场国际汇率战争之中,全球货币正普遍走软。这对我们构成了威胁,因为它削弱了我们的竞争力。”巴西财政部长吉多•曼特加(Guido Mantega)的这些抱怨完全可以理解。在需求匮乏的时代,储备货币的发行国实施扩张性货币政策,而非发行国则以干预汇率作为回应。而那些既不属于前者、也不愿效仿后者的国家(比如巴西)则发现本币大幅升值。其后果令它们担忧。

发生这种汇率冲突并不是第一次。25年前,也就是1985年9月,法国、西德、日本、美国与英国政府在纽约的广场饭店(Plaza Hotel)举行会议,达成了共同诱导美元贬值的协议。更早一些时候,在1971年8月,美国总统理查德•尼克松(Richard Nixon)实施了“尼克松冲击”措施,包括征收10%的进口附加税,并结束美元与黄金的相互兑换。上述两件事都反映出美国渴望美元贬值。今天,美国仍然怀有同样的渴望。但这一次的情况有所不同:关注焦点已不再是日本这样恭顺的盟国,而是下一个全球超级大国——中国。两强相争,很容易伤及围观者。

有三大因素,与眼下的汇率战争相关。

首先,由于这场危机,发达国家正蒙受需求长期匮乏之苦。全球6大高收入经济体——美国、日本、德国、法国、英国与意大利——中,没有一个国家今年第二季度的国内生产总值(GDP)恢复到2008年第一季度的水平。与以往的趋势水平相比,这些国家目前的经济增速至多降低了10%。供应过量的一个信号,是美国与欧元区的核心通胀率已经降至1%左右:通货紧缩正在向我们挥手致意。这些国家希望实现出口拉动型增长。贸易逆差国(例如美国)和顺差国(例如日本、德国)都是如此。然而,整体来看,只有新兴经济体转向经常帐户赤字,才有可能实现这一目标。

其次,私人部门正在朝这个方向运转。华盛顿国际金融研究所(Institute for International Finance)在4月份的预测中指出,今年净流入新兴国家的外来私人资金将达到7460亿美元(见图表)。这些新兴国家净流出的私人资金为5660亿美元,能够部分抵消上述流入。尽管如此,由于新兴国家还有着3200亿美元的经常账户盈余以及适度的官方资金流入,在没有政府干涉的情况下,新兴国家仍将实现5350亿美元的外部收支盈余。但若不加干涉,这种情况也不可能发生:经常账户必须平衡资本净流动。调整将通过提高汇率进行。最终,新兴国家将出现经常账户赤字,来自高收入国家的私人资金净流入,将为这种赤字买单。事实上,这正是我们所期待发生的。

最后,外汇储备的不断累积,仍然在阻碍这种自然的调整过程。这些数字代表着官方资金外流(见图表)。1999年1月至2008年7月期间,全球官方外汇储备从1.615万亿美元,增加到7.534万亿美元——增加了5.918万亿美元,令人震惊。或许有人会说,这种增长是经历了早先危机后的一种自我保护。的确,在这场危机中,外汇储备消耗不少:从2008年7月到2009年2月,全球外汇储备减少了4720亿美元。无疑,这帮助那些没有储备货币的国家缓冲了危机影响。但所使用的储备总额,仅占危机前水平的6%。除此之外,2009年2月到2010年5月间,外汇储备又增长了1.324万亿美元,总额接近 8.385万亿美元。重商主义未死!

中国绝对是最明显的干预者:自2009年2月以来,占到了这些外汇累积的40%。到2010年6月,中国外汇储备达到了2.45万亿美元,占全球总量的30%,在其国内生产总值(GDP)中所占比例,攀升到了50%的惊人水平。这种累积肯定会被视为一种巨额出口补贴。

在人类历史上,从来没有一个超级大国的政府,会借给另一个超级大国这么多钱。一些人辩称,这种汇率管理方式不是操纵(与美国国会的观点相左),因为调整可以通过“国内成本与价格的变动”进行。周二出版的英国《金融时报》上,就刊登了美国西部信托公司(Trust Company of the West)科玛尔•斯里库-马尔(Komal Sri-Kumar)的类似观点。如果不是因为中国下了力气、并成功遏制了其干预行为自然会导致的货币及通胀影响,那么,这种论点会更具说服力。与此同时,新兴国家向着经常账户赤字方向、不可避免的调整,正转移至那些对资金流入具有吸引力、同时又不愿(或无力)对外汇市场实施必要规模干预的国家。可怜的巴西!甚至,我们可能正目睹又一场新兴市场金融危机的发令枪响起?

众所周知,尼克松时期的财政部长约翰•康纳利(John Connally)曾告诉欧洲人,美元是“我们的货币,但是是你们的问题”。中国也作出了同样的回应。由于没有作出汇率调整,我们正看到某种形式的“货币战争”:本质上,美国正寻求让中国通胀,而中国则试图让美国通缩。双方都坚信自己是对的;但都没有获得预期的效果;世界其它国家则受到了牵连。

不难看出中国的观点:它正不顾一切地避免自己心目中日本在《广场协议》(Plaza Accord)后的悲惨命运。当初,由于汇率飙升损害了出口竞争力,加之美国强迫其削减经常账户盈余,日本选择了规模巨大的货币扩张,而不是亟需的结构性改革。随之产生的泡沫,促成了上世纪90年代“失落的十年”。曾经的天下无敌,就此陷入了萧条。对于中国来说,任何这样的结果都将是一场灾难,这一点不言而喻。与此同时,如果没有从高收入国家向其它国家的巨额净资本流入,我们很难设想全球经济会有一个稳健的结构。不过,如果全球最大、且最成功的新兴经济体也是最大的资金净输出国,我们也很难想象这种情况会发生,而且可以持续。

我们所需要的,是找到这些亟需进行的全球调整的路径。这将不仅需要合作的意愿——眼下似乎严重匮乏,还需要在国内与国际改革方面更丰富的想象力。我很想做一个乐观主义者。但我不是:一个充斥着以邻为壑政策的世界,最不可能会有美好的结局。

译者/何黎

******************************

Currency wars in an era of chronically weak demand

“We’re in the midst of an international currency war, a general weakening of currency. This threatens us because it takes away our competitiveness.” This complaint by Guido Mantega, Brazil’s finance minister, is entirely understandable. In an era of deficient demand, issuers of reserve currencies adopt monetary expansion and non-issuers respond with currency intervention. Those, like Brazil, who are not among the former and prefer not to copy the latter, find their currencies soaring. They fear the results.

This is not the first time for such currency conflicts. In September 1985, now 25 years ago, the governments of France, West Germany, Japan, the US and the UK met at the Plaza Hotel in New York and agreed to push for depreciation of the US dollar. Earlier still, in August 1971, the US president Richard Nixon imposed the “Nixon shock”, imposing a 10 per cent import surcharge and ending dollar convertibility into gold. Both events reflected the US desire to depreciate the dollar. It has the same desire today. But this time is different: the focus of attention is not a compliant ally, such as Japan, but the world’s next superpower: China. When such elephants fight, bystanders are likely to be trampled.

Here there are three facts, relevant to today’s currency wars.

First, as a result of the crisis, the developed world is suffering from chronically deficient demand. In none of the six biggest high-income economies – the US, Japan, Germany, France, the UK and Italy – was gross domestic product in the second quarter of this year back to where it was in the first quarter of 2008. These economies are now operating at up to 10 per cent below their past trends. One indication of the excess supply is the decline in core inflation to close to 1 per cent in the US and the eurozone: deflation beckons. These countries hope for export-led growth. This is true both of those with trade deficits (such as the US) and of those with surpluses (such as Germany and Japan). In aggregate, however, this can only happen if emerging economies shift towards current account deficit.

Second, private sectors are working in just this direction. In its April forecasts (soon to be updated), the Washington-based Institute for International Finance suggested that this year the net flow of external private finance into the emerging countries would be $746bn (see chart). This would be partially offset by a net private outflow from these countries of $566bn. Nevertheless, with a current account surplus of $320bn as well, and modest official capital inflows, the external balance of the emerging world, without official intervention, would be a surplus of $535bn. But, without the intervention, that could not happen: the current account must balance the net capital flow. The adjustment would go via a higher exchange rate. In the end, the emerging world would run a current account deficit financed by a net inflow of private capital from the high-income countries. Indeed, that is precisely what one would expect to happen.

Third, this natural adjustment continues to be thwarted by the build-up of foreign currency reserves,. These sums represent an official capital outflow (see chart). Between January 1999 and July 2008, the world’s official reserves rose from $1,615bn to $7,534bn – a staggering increase of $5,918bn. This increase was, one might argue, a form of self-insurance after earlier crises. Indeed, reserves were used up during this crisis: they shrank by $472bn between July 2008 and February 2009. No doubt, this helped countries without reserve currencies cushion the impact. But this use of reserves was a mere 6 per cent of the pre-crisis level. Moreover, between February 2009 and May 2010, reserves rose by another $1,324bn, to reach close to $8,385bn. Mercantilism lives!

China is overwhelmingly the dominant intervener, accounting for 40 per cent of the accumulation since February 2009. By June 2010, its reserves had reached $2,450bn, 30 per cent of the world total and a staggering 50 per cent of its own GDP. This accumulation must be viewed as a huge export subsidy.

Never in human history can the government of one superpower have lent so much to that of another. Some argue – Komal Sri-Kumar of the Trust Company of the West, in Tuesday’s Financial Times, for example – that such management of the exchange rate is not manipulative, contrary to views in the US Congress, since adjustment can occur via “changes in domestic costs and prices”. This argument would be more convincing if China had not worked hard and successfully to suppress the natural monetary and so inflationary consequences of its intervention. In the meantime, the inevitable adjustment towards current account deficits in the emerging world is being shifted on to countries that are both attractive to capital inflows and unwilling or unable to intervene in the currency markets on the needed scale. Poor Brazil! Could we even be seeing the starting gun for the next emerging market financial crisis?

John Connally, Nixon’s secretary of the Treasury, famously told the Europeans that the dollar “is our currency, but your problem”. The Chinese respond in kind. In the absence of currency adjustments, we are seeing a form of monetary warfare: in effect, the US is seeking to inflate China, and China to deflate the US. Both sides are convinced they are right; neither is succeeding; and the rest of the world suffers.

It is not hard to see China’s point of view: it is desperate to avoid what it views as the dire fate of Japan after the Plaza accord. With export competitiveness damaged by its soaring currency and pressured by the US to reduce its current account surplus, Japan chose not the needed structural reforms, but a huge monetary expansion, instead. The consequent bubble helped deliver the “lost decade” of the 1990s. Once a world-beater, Japan fell into the doldrums. For China, self-evidently, any such outcome would be a catastrophe. At the same time, it is difficult to envisage a robust configuration of the world economy without large net capital flows from the high-income countries to the rest. Yet it is also hard to imagine that happening, on a sustainable basis, if the world’s biggest and most successful emerging economy is also its largest net exporter of capital.

What is needed is a route to these needed global adjustments. That will demand not just a will to co-operate that now seems sorely lacking, but greater imagination about both domestic and international reforms. I would like to be optimistic. But I am not: a world of beggar-my-neighbour policy is most unlikely to end well.

感謝D君提供,絕妙的譬喻!怎麼沒提到法國呀?要不大夥兒集思廣益多加幾國...^^

- by Eve

世界是个班...

1、美国

班长,家里有钱,人长得也强壮,学习成绩很好但也爱打架,做事蛮横无理,班里同学一般都不敢顶撞他。和副班长关系不好。

2、俄罗斯

副班长,学习成绩好,全班最高大,上学期光和班长顶着干。后来家里出事:分家!现在做事很消极,但在班级里有一定的影响力。

3、英国

学习委员,学习成绩好。家里也很富。班长的跟屁虫,做事没主见,啥都听班长的。前些天和班长把伊拉克打了一顿。

4、瑞士

美术课代表,班花,学习成绩好, 不跟别人勾三搭四,很文静很内向。

5、阿根廷

体育课代表的同桌,不久前和学习委员打架打输了,现在每次体育课都抱着学习委员狂整。

6、阿富汗

职务无。成绩差。身材矮小。上学期被副班长打,班长帮忙付医药费。前几天把班长家最高的两个家具砸了,被班长揍个半死,现在 失忆中。

7、伊拉克

无职务,学习差。但人高马大,上学期排全班第四。嘴硬,上学期欺负同桌被群殴。前些天被班长和学习委员冲进他家揍个稀巴烂。

8、科威特

职务无,伊拉克同桌,以前老被伊拉克欺负,幸好有班长撑腰。

9、埃及

历史课代表,成绩平平,家里有金字塔,所以当历史课代表。

10、伊朗

职务无,成绩不好,偶尔也顶撞班长,这几天顶劲更大了。家里刚刚发生地震,班里为他家举行了募捐活动。

11、印度

因为好玩电脑,成了电脑课代表,特点看似敦实却不厚道,经常和同桌巴基斯坦为一块课桌吵架。

12、巴基斯坦

无职务。印度同桌,身材不高,成绩也不怎么样,跟团支书关系不错,所以敢经常和印度顶着干。

13、澳大利亚

职务无,学习中等偏上,管学习委员叫老大,做事没主见,学习委员说一他不敢说二。

14、以色列

职务无,成绩不错,但就是看同桌巴勒斯坦不舒服,动不动就凑人家一顿。

15、巴勒斯坦

职务无,身材瘦弱,没家庭背景,经常被以色列揍得打落牙齿也只能往肚里咽。

16、德国

劳动委员(尚未经班委会通过,代任中)学习勤奋又比较吃苦耐劳,成绩也很好。上学期打了两次架,结果害得当时的班长——英国今年落选。

17、日本

无职位,学习成绩很好。思想品德很{巨}差,人龌龊鬼点子多,上学期因为欺负人、抢东西被班长带人狂揍,被打成半身不遂,伤好后不思悔改,现在又开始“惦记”团支书家的鱼缸了。

18、越南

无职位。学习成绩差。瘦弱。上学期被班长揍,幸好有副班长和团支书撑腰。后又挑衅团支书,被狂揍。

19、朝鲜

无职位,团支书同桌,学习成绩差,嘴却很硬,经常得罪班长,班长几次扬言要揍他,碍于其同桌团支书才没动手。

20、中国

团支书。幼儿园、小学学习成绩很好。小学毕业时由于贪睡、不爱出门运动、体质差常被欺负。上学期和本学期进步很快。有正义感,该出手时不手软。上学期为了同桌朝鲜和班长打了一架。现在成绩进步很快,身体锻炼的也较好,常常做梦都想收拾几个人出出气,因怕影响学习成绩而经常忍气吞声,班长为此很“担心”。

21、 韩国

无职位,团支书后桌,学习成绩差,势利眼,爱幻想,嫌贫爱富,却一直被人欺负。窝窝囊囊,手脚不干净,爱偷东西。 小学就和支书同桌,总像跟屁虫似的跟着支书。中学时看到日本同学有钱有势,改投日本门下,却总被欺负。后来和班长关系不错,和穷兄弟朝鲜分了家,日子过得稍有起色,但还是被班长欺负,班长经常酒后醉宿其家中,还欺负她的姐妹,它也是敢怒不敢言。从小到大打假,却从来都是挨揍那个。 经常偷支书家的东西,幻想称霸全班。和穷兄弟,支书及副班长关系紧张。属于猪八戒照镜子。

圖說:1904年〈慈禧太后畫像〉局部,慈禧時年近70歲,保養得宜,猶如40歲婦女。圖/史博館提供。

來源:古美術 2010-10-08

記者:文‧攝影/藍玉琦

慈禧太后和世界博覽會有什麼關係?國立歷史博物館「慈禧與世博─一幅畫像背後的故事」將這一段歷史娓娓道來。

時間回到清末,慈禧太后坐擁大權,統治中國。庚子事變「扶清滅洋」後,慈禧在西方報刊漫畫中被醜化為殘忍的老暴君,又適逢中國官方首度受邀參加1904年在美國舉辦的聖路易斯世博會,美國大使康格的夫人莎拉.派克.康格(Sarah Pike Conger)於是建議太后畫像,以正視聽,扭轉印象。1903年美國女畫家凱瑟琳.卡爾(Katharine Augusta Carl)受邀入頤和園為慈禧畫像,她說:「若非我知道她已年近六十九,我會以為他是保養得宜的四十歲婦女。寡婦之身的她並不用化妝品,臉上浮現自然健康的光澤。」她為慈禧畫成四幅畫作,只有兩幅存世,一幅在北京頤和園,一幅就是史博館正在展出的〈慈禧太后畫像〉。

畫中慈禧身著明黃色朝袍、珍珠披肩,黃金、翡翠的護指,光彩華麗;身後景泰藍屏風,重彩繪成九隻鳳凰,八鳳口銜「八吉祥」:法螺、法輪、寶傘、白蓋、蓮花、寶瓶、金魚與盤長,正中之鳳凰則銜「慈禧皇太后之寶」朱印,華美吉祥,女畫家並於宮中指定之「吉時」1904年4月19日4點前完成最後一筆。該油畫寬163厘米、長271厘米,鑲嵌在雕花框座上更是高達484厘米,比二個NBA休士頓火箭隊球員姚明巨人還高,令人不得不瞻仰「聖容」。據女畫家憶述,該框座由慈禧設計,以珍稀樟木雕成,最頂端雕雙龍搶奪壽字火珠,整體紋飾以壽字與龍為主,不見鳳的蹤跡。該畫於世博展結束後,贈與美國總統老羅斯福,清廷藉由此舉對美釋放外交善意,隨後該畫進入華盛頓史密斯桑尼亞機構的美國藝術館典藏。

1965年史博館首任館長包遵彭赴美,爭取畫作來台。1966年〈慈禧太后畫像〉飄洋過海,以「永久借展」(permanent loan)名義藏於史博館,近半世紀過去了,慈禧更老了,部分油彩斑駁剝落,時間饒不過,留下歲月的痕跡。展場上除畫像外,更有慈禧〈福.壽〉書法,並以螺鈿家具、青花瓷、瓷版畫等館藏文物擬塑1904年世博情境,更設計有歷年世博會的相關圖文簡表、2010年世博台灣館模型及影片,串聯古今,看慈禧,讀歷史,遊世博。

〈慈禧太后畫像〉展至10月17日,之後歸還美國,屆時真的是慈禧與世博都再見了!

對寧兒、蓉兒,一直掙扎要不要如文章中的父母們那般用心良苦幫孩子安排課外才藝。我不喜歡孩子接受強迫式的學習;但又擔心不試試,可能剝奪發現她們「天才」的一面。

幾番嘗試,孩子漫不經心的表現讓我灰心。當然渴望孩子到哪兒都能出類拔萃,但畢竟自己成長過程的學習表現不一直都是熠熠生輝,所以勸自己,對孩子不能過分要求。

快樂的童年,還是難能可貴...

- by Eve

作者:劉繼榮

女兒的同學都管她叫「二十三號女生」。

她的班上總共有五十個人,每次考試女兒都排名第二十三,久而久之,便有了這個雅號,她也就成了名副其實的中等生。

我們覺得這外號刺耳,女兒卻欣然接受。老公發愁地說,一碰到公司活動,或者老同學聚會,別人都對自家的「小超人」讚不絕口,他卻只能扮深沉,人家的孩子,不僅成績出類拔萃,而且才藝兼備,連父母都顯得春風得意,說話比別人大聲。唯有我們家的「二十三號女生」,沒有一樣值得炫耀的地方。

因此,往往他一看到娛樂節目裏那些才藝非凡的孩子,就羡慕得兩眼放光,恨不能變成親友團,坐在前排呐喊。後來,看到一則九歲孩子上大學的報導,他很受傷地問女兒:「孩子,你怎麼就不是個神童呢?」女兒的回答更妙:「老爸,因為你不是神父啊!」老公無言以對,我卻不禁笑出聲來。

中秋節,親友相聚,坐滿了一個寬大的包廂。眾人的話題,也漸漸轉向各家的小兒女。乘著酒興,要孩子們說說將來要做什麼。

鋼琴家、明星、政界要人,孩子們毫不怯場,連那個四歲半的女孩,也說將來要做電視主持人,贏得一陣讚歎。大人們愈發春風入心,眉目含笑,家宴的氣氛格外熱烈。

十二歲的女兒,正為身邊的小弟妹,剔蟹剝蝦、盛湯擦嘴,忙得不亦樂乎。人們忽然想起,只剩她沒說了,大家都認為,她是孩子中間的老大,抱負更應該不同凡響,才能做弟妹們的榜樣。

在眾人的催促下,她認真地回答:「長大了,我的第一志願是當幼稚園老師,帶著孩子們唱歌跳舞、做遊戲。」

眾人禮貌地表示讚許,但不放過緊接著追問她的第二志願。她大大方方地說:「我想做一位媽媽,穿著卡通圖案的圍裙,在廚房裏做晚餐,然後為我的孩子講故事,帶他在陽臺上看星星。」

親友愕然,面面相覷,不知道該說些什麼。老公的神情極為尷尬,端著酒杯,一句話也說不出來。回家後,他嘆著氣說:「你還真打算讓女兒將來當個幼稚園老師?我們難道真的眼睜睜地,看著她當中等生?」

其實,我們也動過很多腦筋。從小到大,為提高她的學習成績,請家教、報課輔班、買各式各樣習題文本。孩子也懂事,漫畫書不看了鎖在抽屜裏;剪紙班退出了;週末的懒覺放棄了。像一隻疲憊的小鳥,從一個班辛辛苦苦地趕到另一個班。試卷、練習冊,一本本攤在書桌上,頭也不抬地一疊疊地猛做。

她到底是個孩子,身體首先撐不住了,天氣轉涼就得了重感冒。在病床上打著點滴,她還堅持寫作業,最後引發了肺炎,住院半個多月。出院後,孩子的臉小了一圈,聲音嘶啞,仿佛剛從戰場上廝殺回來。付出了這樣慘重的代價,期末考試的成績一出來,仍然是讓我們哭笑不得的第二十三名。

後來,我們再度絞盡腦汁,嚐試增加營養、獎品、禮物作為激勵……三番兩次折騰下來,女兒的小臉越來越蒼白。而且一說要考試,她就開始厭食、失眠、冒虛汗,再接著,考出了令我們啞口無言的第三十三名。

我和老公舉手投降了,完全放棄轟轟烈烈的揠苗助長活動。恢復了她正常的作息時間,還給她畫漫畫的權利,允許她繼續訂休閒閱讀的書報,接著,家中安穩了很久。我們對女兒是心疼的,但面對她的成績,又有說不出的困惑。

週末,一群同事結伴郊遊,大家各自做了拿手的菜,帶著老公和孩子野餐去。一路上笑語盈盈,這家孩子唱歌,那家孩子表演小品,女兒沒什麼看家本領,只是開心地不停鼓掌,同時,她亦不時跑到後面照看那些食物──把傾斜的飯盒擺好、鬆了的瓶蓋轉緊、流出的菜汁抹淨,四處照應,像個細心的小管家。

老公看看我,我知道他心裏是有期待的,他一定希望女兒能接受別人的掌聲,而不是只為別人鼓掌。

野餐的時候發生了一件意外,兩個小男孩,一個數學頂尖,一個是英語高手,同時夾住盤子裏的一塊糯米餅,誰也不肯放手,更不願平分。豐盛的美食,源源不斷地擺上來,驕傲的他們看都不看,只盯住眼前這一塊小小的碎餅。

大人們連勸帶哄,怎麼都不管用。最後,還是女兒用擲硬幣的方法,輕鬆地打破了這個僵局。我與老公對看了一眼,心頭有個微微的聲音:「沒想到,這個不吭氣的孩子,竟是個處理衝突的高手!」

回程的路上堵車,一些孩子焦躁起來,大人也開始不耐煩,車裏沒有了早晨快樂融融的氣氛,這時,女兒大大方方地開口了,新鮮的笑話一個接一個,她自己很平靜,但把全車人都逗樂了。

嘴裏說著,她手底下也沒閒著,那一堆盛裝食物的彩色紙盒,被剪成了許多栩栩如生的小動物,引得其他孩子讚歎不已。到了下車的時候,每個人都拿到了自己的生肖剪紙。看到孩子們圍著女兒連連道謝,並要求女兒在剪紙上簽名時,老公終於露出了自豪的微笑。

期中考後,我接到了女兒班導師的電話,首先得知,女兒的成績仍是中等,對於這個消息,我跟老公並不感到意外。不過,他說,有一件奇怪的事想告訴我,他從事教職三十年,第一次遇見這種事。

語文試卷上有一道附加題:「你最欣賞班上哪位同學,請說出理由。」除女兒之外,全班同學竟然都寫上了女兒的名字。理由大致上有──熱心助人、守信用、不愛生氣、好相處等等,寫得最多的評語是──樂觀幽默、善良聰明。而且很多同學建議,由她來擔任班長。班導師感歎道:「你這個女兒,雖然說成績一般,但做人處事實在是很優秀。」

我開玩笑地對女兒說:「孩子,你快要成為英雄了!」正在織圍巾的女兒,側著頭想了想,認真地告訴我,英語老師在上課時曾講過一句格言:「當英雄路過的時候,總要有人坐在路邊鼓掌。」她輕輕地說:「媽媽,我不想成為英雄,我想成為坐在路邊鼓掌的人。」

在溫柔的燈光底下,她安靜地織著手中的絨線,淡粉的線在竹針上纏纏繞繞,仿佛一寸一寸的光陰,在她手裏吐出了星星點點的花蕾,我心裏,竟是驀地一暖。那一刻,我忽然被這個不想成為英雄的女孩打動了。

這世間有多少人,年少時渴望成為英雄,最終卻成了煙火紅塵裏的平凡人,終其一生都不能釋懷。如果健康、如果快樂,如果,沒有違背自己的心意,我們的孩子,又何妨做一個善良的普通人。

長大成人後,她不會是最耀眼的那一個,她也許會成為──賢淑的妻子、溫柔的母親,或者是熱心的同事、和善的鄰居。在那些漫長的歲月裏,她都能安然地過著自己想要的生活。做為父母,還想為孩子祈求怎樣更好的未來呢?

地球最嚴重的汙染源應該是人類...

-by Eve

來源:《聯合新聞網》2010/10/08

匈牙利中部一間鋁工廠從4日起外洩的強鹼性毒汙泥,7日流進了歐洲第二長河多瑙河,並造成一條支流生態大滅絕。歐盟官員憂心,紅色毒汙泥水造成的環境浩劫,可能影響藍色多瑙河下游六國。

官員表示,匈牙利MAL Magyar鋁工廠的廢水池堤防4日崩裂,外洩的煉鋁汙泥7日流進布達佩斯西邊120公里處的多瑙河。毒水酸鹼度(pH值)一度 高達13,屬於高腐蝕性強鹼,還含有鉛、鎘、砷、鉻等重金屬,碰觸者非死即傷,迄今已造成4死、120人住院。

區域災害應變中心主任達布森表示,科學家一直在努力降低遭毒汙泥汙染的馬卡(Marcal)與拉巴(Raba)兩條河流河水酸鹼值,拉巴河和多瑙河匯流處,河水pH值約9.3,略高於正常值上限8,幸好當地尚未出現魚類死亡現象。

多瑙河發源於德國,依次流經奧地利、斯洛伐克、匈牙利、克羅埃西亞、塞爾維亞、保加利亞、羅馬尼亞、烏克蘭,最後流進黑海。專家預計,鋁汙泥將於9日抵達羅馬尼亞。目前匈牙利以降的下游6國都相當緊張,官員每隔幾小時就檢測多瑙河水一次,除了擔心酸鹼值,也怕重金屬汙染。

拉巴是多瑙河的支流。馬卡河則是拉巴的支流。馬卡河流經鋁汙泥外洩的廠址,河中動植物已全數死亡。達布森表示:「強鹼讓所有生物都難以存活。魚都死光光了,植物我們也沒救成。我們倒進數千噸的硫酸鈣(石膏)試圖中和強鹼,但都徒勞無功。」

匈牙利總理歐本(Viktor Orban) 7日視察災區後表示,由於重金屬已經滲透進入土地,當地已經不可復原,災民可能必須遷居:「毀損的房舍必須用圍籬隔開,讓後代子孫了解這裡發生過什麼事情。」

距離鋁工廠不到1公里的柯倫塔(Kolontar),鋁汙泥淹到兩公尺高。估計有100萬立方公尺的鋁汙泥外洩,影響區域面積至少 50平方公里。歐本重申,整起事件應屬人為疏失,一定有人得負責。

作者:庞忠甲(旅美华人) 2010-10-06

溯诸《尚书•尧典》,远古时期中国杰出的政治领袖们早就痛切体认到权力腐化、“慢神虐民”的严重恶果,懂得“民惟邦本,本固邦宁”,必须以代表人民利益为己任,“若保赤子,惟民其康。”方能“钦崇天道,永保天命”。

西学东渐之前,中国政论家阐发为君之道,为政之道,亦即治国之道,看来头头是道,深透到了无以复加的完美程度。遗憾的是,偏偏致命地短缺了决定性的一章就是“权力制衡”。

权力只能用权力来约束。一个国家如果缺乏有效的“权力制衡”机制,拥有政治权力,特别是绝对权力的统治阶层成员难免为“原罪”驱使,一步步偏离美好立意,背叛神圣承诺;他们当中一些人会戴着代表人民利益的光环,利用人民信托的权力,以人民公仆的冠冕堂皇,去行较之明火执杖的强盗可恶不知多少倍之大恶。

中国改革开放大见成效,经济增长速度举世瞩目,已经把国家带上了历史上最好的发展时期。但是在政治文明建设上,多侧重机构改革,属行政改革层次,尚未涉及共和性质的“权力制衡”建设。

虽然早在二十年前就已启动了意义深远的法治建设进程,比起十年二十年前,中国的法制建设应该说不知强化了多少倍。但是缺乏有效的“权力制衡”作保证,决定了监督少效或无效的必然性,所谓“以法治国”其实难为。以权力腐化为例,便一目了然。党和国家不断加大反腐倡廉力度,在立法和监督上所花的人力物力不可谓不大,至少可称“算术级数增长”,随之却是“几何级数增长”的官场腐败现象,甚至不少反腐战线上的干部也倒戈叛变纷纷加入腐败行列。

中国整个政治民主化建设是一个与先进文化建设相辅而行的谨慎的缓进过程。但是形势逼人,时不我待,体现立党立国之本的共和精神,即“权力制衡”可以先行,而且应该先行。非如此何以克服“绝对腐化”狂澜既倒,何以因应日渐恶化的社会矛盾和瓶颈效应的挑战,何以继续深化经济改革,何以实践立党为公、执政为民,维系执政党的合法性,贯彻“三个代表”指导思想,实现构建“和谐社会”的神圣使命?

中国迫切需要的是具有共和内涵的,亦即“权力制衡”先行的民主化建设。换言之,“权力制衡”内涵有无,就是当今中国一切政治体制改革方案真假虚实的试金石。

一直以來,都想取得些海峽對岸有關「大躍進」到大飢荒、文革十年...等事件的真實面貌。感謝網路世界的無遠弗界,最近看了許多。

有些文章專提冰冷的統計數字,有些文章紀錄野蠻又血淚斑斑的故事,都讓我很難相信這場浩劫居然發生在自許為文明古國的中國。駭人聽聞卻又真實,給了我強烈的衝擊,也讓我明白了些事情,「心」是沉重的。

這篇《一百个人的十年》前言,作者為這場千千萬萬中國人參與的世紀浩劫下了一個完美的注解,也代我說出心聲,刊出分享。

- by Eve

作者:冯骥才

二十世纪历史将以最沉重的笔墨,记载这人类的两大悲剧:法西斯暴行和“文革”浩劫。凡是这两大劫难的亲身经历者,都在努力忘却它,又无法忘却它。文学家与史学家有各自不同的记载方式:史学家偏重于灾难的史实;文学家偏重于受难者的心灵。本书作者试图以一百个普通中国人在“文革”中心灵历程的真实记录,显现那场旷古未闻的劫难的真相。

在延绵不绝的历史时间里,十年不过是眨眼的一瞬。但对于一代中国人有如熬度整整一个世纪。如今三十岁以上的人,几乎没有一个人的命运不受其恶性的支配。在这十年中,雄厚的古老文明奇迹般地消失,人间演出原始蒙昧时代的互相残杀;善与美转入地下,丑与恶肆意宣泄;千千万万家庭被轰毁,千千万万生命被吞噬。无论压在这狂浪下边的还是掀动这狂浪的,都是它的牺牲品。哪怕最成熟的性格也要接受它强制性的重新塑造。坚强的化为怯弱,诚实的化为诡诈,恬静的化为疯狂,豁朗的化为阴沉。人性、人道、人权、人的尊严、人的价值,所有含有人的最高贵的成分,都是它公开践踏的内容。虽然这不是大动干戈的战争,再惨烈的战争也难以达到如此残醋——灵魂的虐杀。如果说法西斯暴行留下的是难以数计的血淋淋的尸体,“文革”浩劫留下的是难以数计的看不见的创伤累累的灵魂。

尽管灾难已经过去,谁对这些无辜的受难者负责?无论活人还是死者,对他们最好的偿还方式,莫过于深究这场灾难的根由,铲除培植灾难的土壤。一代人付出如此惨重的代价,理应换取不再重蹈复辙的真正保证。这保证首先来自透彻的认识。不管财代曾经陷入怎样地荒唐狂乱,一旦清醒就是向前跨了一大步。每一代人都为下一代活着,也为下一代死。如果后世之人因此警醒,永远再不重复我们这一代人的苦难,我们虽然大不幸也是活得最有价值的一代。

我常常悲哀地感到,我们的民族过于健忘。“文革”不过十年,已经很少再见提及。那些曾经笼罩人人脸上的阴影如今在哪里?也许由于上千年封建政治的高压,小百姓习惯用抹掉记忆的方式对付苦难。但是,如此乐观未必是一个民族的优长,或许是种可爱的愚昧。历史的过错原本是一宗难得的财富,丢掉这财富便会陷入新的盲目。

在本书写作中,我却获得新的发现。

这些向我诉说“文革”经历者,都与我素不相识。他们听决我要为他们记载“文革”经历,急渴渴设法找到我。这急迫感不断给我以猛烈的撞击。我记载的要求只有一条,是肯于向我袒露心中的秘密。我想要实现这想法并非易事。以我的人生经验,每人心中都有一块天地绝对属于他自己的,永不示人;更深的痛苦只能埋藏得更深。可是当这些人倘着泪水向我吐露压在心底的隐私时,我才知道,世上最沉重的还是人的心。但他们守不住痛苦,渴望拆掉心的围栏,他们无法永远沉默,也不会永远沉默。这是为了寻求一种摆脱,一种慰藉,一种发泄,一种报复,更是寻求真正的理解。在那场人间相互戕害而失去了相互信任之后,我为得到这样无戒备无保留的信赖而深感欣慰。

为了保护这些人的隐私,也为了使他们不再受到可能的麻烦所纠缠,本书不得不隐去一切有关的地名和人名。但对他们的口述照实记录,不做任何演染和虚构。我只想使读者知道如今世上一些人曾经这样或那样度过“文革”走到今天;也想使后人知道,地球上曾经有一些人这样难以置信地活过。他们不是小说家创造的人物,而是“文革”生活创造的一个个活生生真实的人。

我时时想过,那场灾难过后,曾经作恶的人躲到哪里去了?在法西斯祸乱中的不少作恶者,德国人或日本人,事过之后,由于抵抗不住发自心底的内疚去寻短见。难道“文革”中的作恶者却能活得若无其事,没有复苏的良知折磨他们?我们民族的神经竟然这样强硬,以致使我感到陈阵冰冷。但这一次,我有幸听到一些良心的不安,听到我期待已久的沉重的仟悔。这是恶的坚冰化为善的春水流露的清音。我从中获知,推动“文革”悲剧的,不仅是遥远的历史文化和直接的社会政治的原因。人性的弱点,妒嫉、怯弱、自我、虚荣,乃至人性的优点,勇敢、忠实、虞诚,全部被调动出来,成为可怕的动力。它使我更加确认,政治一旦离开人道精神,社会悲剧的重演则不可避免。

“文革”是我们政治、文化、民族疯疾的总爆发,要理清它绝非一朝一夕之事;而时代不因某一事件的结束而割断,昨天与今天是非利害的经纬横竖纠缠,究明这一切依然需要勇气,更需要时间,也许只有后人才能完成。因此本书不奢望绘读者任何聪明的结论,只想让这些实实在在的事实说话,在重新回顾“文革”经历者心灵的画面时,引起更深的思索。没有一层深于一层的不浅尝辄止的思索,就无法接近真理性的答案。没有答案的历史是永无平静的。

尽管我力图以一百个人各不相同的经历,尽可能反映这一历经十年、全社会大劫难异常复杂的全貌,实际上难以如愿;若要对这数亿人经验过的生活做出宏观的概括,任何个人都方不能及。我努力做的,只能在我所能接触到的人中间,进行心灵体验上所具独特性的选择。至于经历本身的独特,无需我去寻找。在无比强大的社会破坏力面前,各种命运的奇迹都会呈现,再大胆的想象也会相形见细。但我不想收集各种苦难的奇观,只想寻求受难者心灵的真实。我有意记录普通人的经历,因为只有底层小百姓的真实才是生活本质的真实。只有爱惜每一根无名小草,每一颗碧绿的生命,才能紧紧拥抱住整个草原,才能深深感受到它的精神气质,它惊人的忍受力,它求生的渴望,它对美好的不懈追求,它深沉的忧虑,以及它对大地永无猜疑、近似于愚者的赤诚。

我相信“文革”的受难者们都能从本书感受到这种东西以使内心获得宁静;那些“文革”的制造者们将从中受到人类良知的提醒而引起终生的不安。我永远感谢为这本书,向我倾诉衷肠而再一次感受心灵苦痛的陌生朋友们。是他们和我一同完成这项神圣的工作:纪念过去和启示未来。

写于1986年